Innovation in IT is the backbone of modern banking, but staying ahead of evolving demands comes with significant hurdles. Legacy systems, complex integrations, and the ever-growing need for scalability can limit agility, while stringent security and compliance requirements add layers of complexity.

To deliver seamless, future-proof solutions, IT teams must balance innovation with reliability, ensuring that systems are both efficient and adaptable. Overcoming these challenges is critical to driving growth, enhancing customer experiences, and maintaining a competitive edge.

Core and legacy infrastructure weren’t built for today’s expectations. Extending capabilities, standing up new experiences, and handling fluctuating demand can strain both systems and teams.

Every new channel or capability adds another connection to maintain. Disconnected platforms create operational risk, inconsistent experiences, and heavy IT overhead.

IT needs clear insight into how systems perform, what users are doing, and where friction lives. Traditional tools often lack the analytics required to tune, govern, and continuously improve.

Adapt Without Disruption

Leverage Directlink’s open, API-driven architecture to layer AI on top of your existing core, telephony, digital banking, and content system, without rip-and-replace projects.

Integrate once, reuse across channels

Scale to meet demand without linear infrastructure and staffing costs

Innovation That Passes the Audit

Directlink is designed for regulated institutions from day one.

Strong encryption and access controls

Policy-aligned outputs governed by your content and rules

Full observability into how AI is used across channels

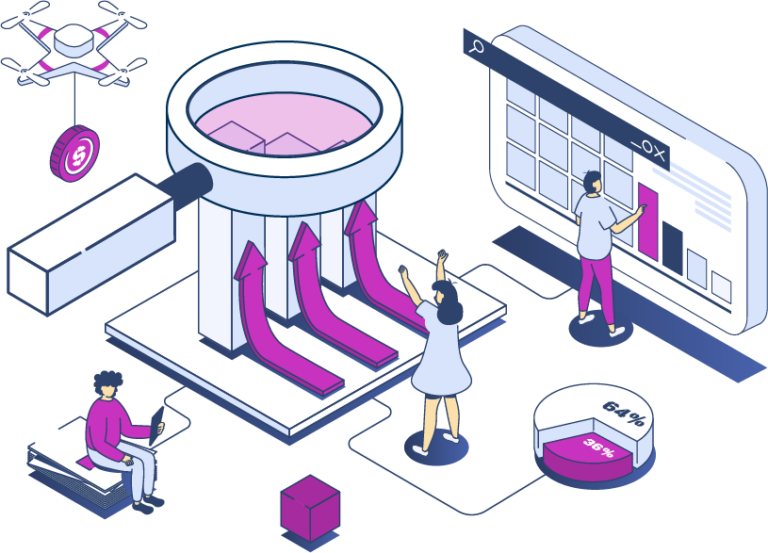

Evolve on Your Terms

Adopt capabilities incrementally while maintaining architectural discipline.

Add new use cases—internal knowledge, voice experiences, digital guidance—on a common platform

Rely on Directlink experts to support deployment, optimization, and ongoing innovation

Conversational AI that replaces scattered documentation with instant, policy-aligned answers empowering staff to work smarter, faster, and always in complianc

Conversational AI that handles everyday banking, resolving account questions, processing transactions, and delivering 24/7 support so your team can focus on higher-value needs.

Conversational AI that supports digital and core banking conversions resolving issues in real time, reducing call volume, and guiding customers through change with confidence.

Traditional IVR keypad solution for secure self-service, giving customers fast access to account info, while easing call volume and supporting high-frequency banking tasks.

Automate up to 50% of customer interactions, with no IT intervention freeing IT resources for strategic initiatives.

Achieve over 99.9% system reliability with AI that reduces downtime and service interruptions.

Deploy AI with minimal disruption, integrating with CRM databases, legacy systems, and modern platforms effortlessly.

Leverage real-time analytics to improve system performance, user experiences, and overall solution capabilites.

Directlink goes beyond a platform—it’s a commitment to seamless service, enhanced efficiency, and genuine connection. Step into the future of banking where every interaction is designed to deliver exceptional outcomes, build trust, and elevate customer experiences.

Use this tool to gain insights into the financial impact of handling routine customer calls:

*Routine calls include account inquiries, transaction queries, transfers and payments, and miscellaneous maintenance.