AI-powered virtual assistants purpose-built to support your institution during digital, core, and M&A migrations, ensuring consistency, scalability, and 24/7 customer support.

Digital and core banking conversions, as well as M&A’s are critical moments of transformation for financial institutions. Directlink helps banks and credit unions navigate these transitions with AI-powered virtual assistants built specifically to handle the challenges of conversion events.

Imperfect customer data reconciliation

Inflexible customer routines are impacted

Unpredictable call volumes and support tickets

Overwhelmed staff not used to such large IT projects

Inconsistent messaging across channels

Inability to broadcast responses to new issues and resolutions

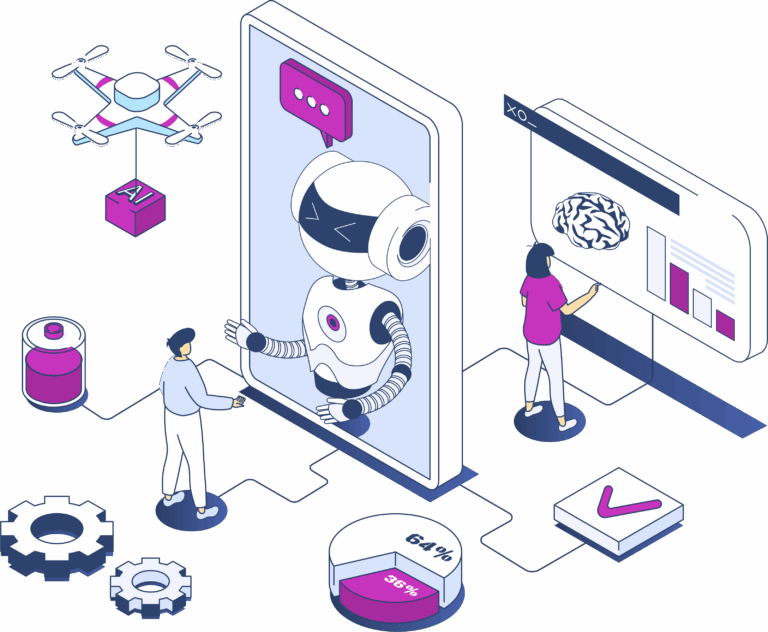

Explore how Directlink’s purpose-built AI platform empowered CFCU to maintain superior service delivery, alleviate agent workload, and create a frictionless experience for members navigating the merger.

An influx of merger-related FAQs

Saved 208hrs of call time

24/7 instant support

Directlink works with any existing phone system and contact center solution, minimizing IT overhead and accelerating deployment.

Directlink continuously analyzes interactions to detect emerging issues and recommends new topics for you to resolve, helping service teams get ahead.

Our AI knowledgebase includes hundreds of FAQs tailored to digital and core migration scenarios, helping you launch with confidence and speed.

Make fast content messaging adjustments without IT involvement, ensuring your AI responds appropriately as new issues arise.

Directlink can also connect to core banking APIs and digital interfaces, enabling real-time account maintenance and support inquiries.

Rapid deployment in 45-60 days

Scalable support with unlimited call handling

24/7 coverage during conversion weekends, and beyond

Significantly cost-competitive compared against outsourcing calls

Conversational AI that replaces scattered documentation with instant, policy-aligned answers empowering staff to work smarter, faster, and always in complianc

Conversational AI that handles everyday banking, resolving account questions, processing transactions, and delivering 24/7 support so your team can focus on higher-value needs.

Traditional IVR keypad solution for secure self-service, giving customers fast access to account info, while easing call volume and supporting high-frequency banking tasks.